China – Suggestions

How to invest in China through Avenue

Here we list two alternatives for you to expose yourself to China.

Please keep in mind that these are not recommendations.

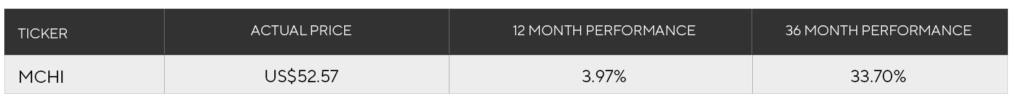

1. iShares MSCI China ETF

The fund focuses its investment on the Chinese market in general, with almost 400 shares in its portfolio. The predominant sectors are consumption, technology, and finance. Large Chinese companies account for more than 80% of the portfolio. It represents a more diverse and general way of exposing yourself to China’s growth.

Top five fund portfolio positions:

![]() Tencent Holdings

Tencent Holdings

![]() China Construction Bank

China Construction Bank

![]() Ping An Insurance Group

Ping An Insurance Group

![]() China Mobile Ltd

China Mobile Ltd

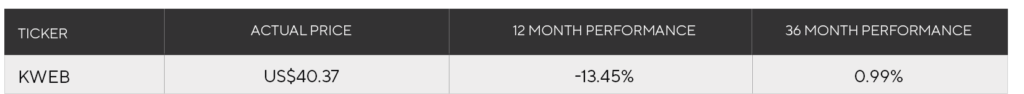

2. KraneShares CSI China Internet ETF (KWEB)

The fund invests in China’s technology stocks – its portfolio has more than 40 companies. Through it, you get exposure to Chinese internet companies that provide similar services like Google, Facebook, Twitter, eBay, Amazon, etc. These companies tend to benefit from increased domestic consumption by China’s growing middle class, as well as being part of a booming sector in China’s bustling economy. The fund still holds a position in some companies listed in the United States and Hong Kong.

Top five Fund portfolio positions:

![]() Alibaba Group Holding Limited (BABA)

Alibaba Group Holding Limited (BABA)

![]() Tencent Holdings

Tencent Holdings

![]() Meituan Dianping

Meituan Dianping

![]() Baidu

Baidu

![]() JD.com

JD.com

1. Google Public Data – Banco Mundial – TradingEconomics.com

2. Google public data – TradingEconomics.com

3. Visualcapitalist.com

4. https://www.cnbc.com/2019/10/21/chinas-economic-growth-could-fall-below-6percent-in-2020-says-the-imf.html

5. https://www.cnbc.com/2019/05/15/us-and-china-race-to-lead-future-of-tech-now-comes-down-to-6-billion.html

https://fortune.com/2019/04/26/biggest-ipos-history-uber/