Breast Cancer – Suggestions

COMPANIES

The idea here is to explore three biotechnology companies looking to develop new solutions for HER2-Positive breast cancers.

Keep in mind, investing involves risk. Examples are for illustrative purposes and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security. Past performance is no guarantee of future results.

SEATTLE GENETICS (SGEN)

Seattle Genetics is a biotechnology company that develops and markets therapies, solutions, and drugs to treat cancer. Founded in 1997 and headquartered in Washington.

It has three therapies approved by the FDA (Foods and Drugs Administration) so far: ADCETRIS (Hodgkin’s Lymphoma), PADCEV (Urothelial Cancer), and TUKYSA. The latter being recently approved and linked to the treatment of HER2-Positive breast cancer.

PADCEV is among the top products since Urothelial Cancer is the most common form of bladder cancer. According to Grand View Research, this disease’s drug market is growing at a CAGR of 22.9% and is expected to reach $ 3.6 billion in 2023.

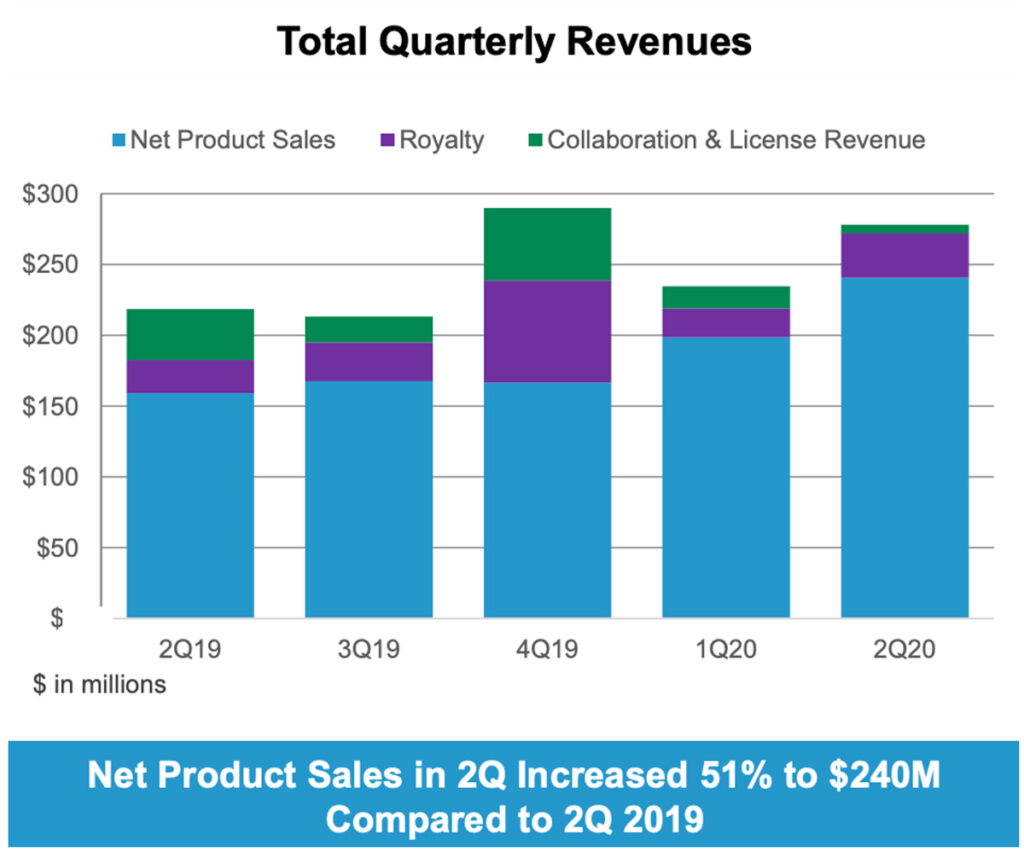

In the second quarter of this year alone, the company delivered $ 278 million in revenue6. PADCEV’s revenues grew 66% compared to 1Q20, which was when it was launched. It is worth mentioning that the second quarter already marks the entry of TUKYSA’s revenue, which stood at $ 15.8 million.

At the same time, as we mentioned earlier, these companies require much capital. Therefore, with the new approvals, the costs of products sold and research costs tend to increase.

The company today has 12 therapies under development. Besides, it is spending more on infrastructure to support growing demand for its products and preparing for its launch in Europe.

However, even with the increase in expenses, it managed to deliver a smaller loss when compared to 2Q19, due to the rise in revenues that it has been having.

It employs 1605 people, and in 2019, it delivered about $ 916 million in annual revenue. Its market value is approximately $ 34.4 billion, and its shares have appreciated by more than 3500% since October 20057.

Source: https://www.marketbeat.com/stocks/NASDAQ/SGEN/

MACROGENICS (MGNX)

MacroGenics is another biotechnology company focused on the treatment of breast cancer and other therapies. Founded in 2000 and headquartered in Maryland.

This company, unlike the previous one, does not have any therapy already developed and in circulation.

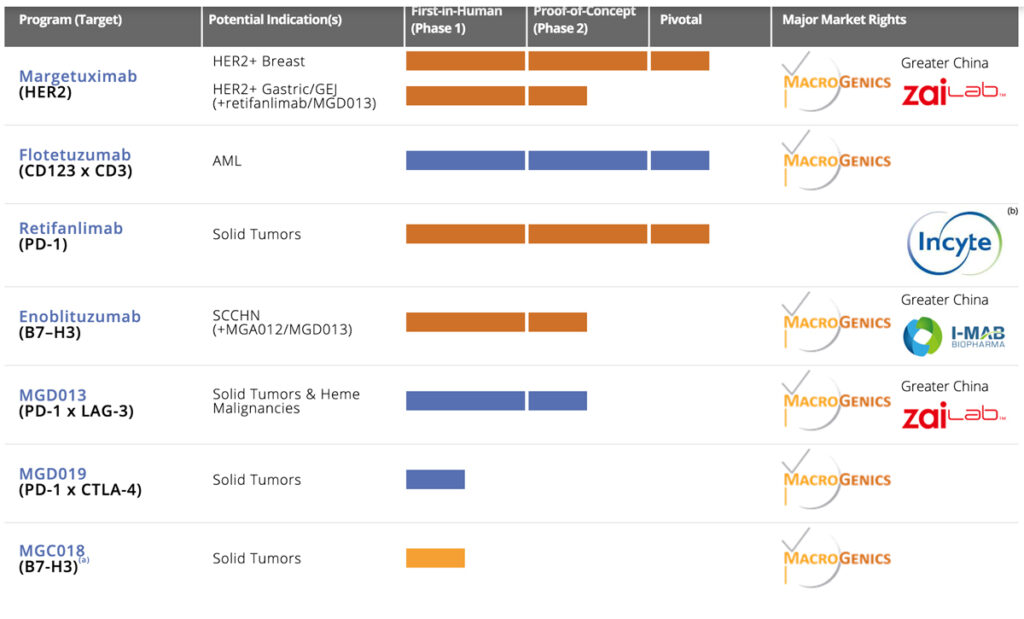

In the pipeline, there are some in several phases 8:

Source: https://www.macrogenics.com/pipeline/

The one that is drawing attention at the moment is Margatuximab (HER2), which is used for the treatment of breast cancer and is one of its therapies that is closest to having FDA validation.

The company has already said it expects the FDA to release the biological license (BLA) by December 18 for treatment and, thus, allow it to market this therapy 9. The company makes money from its strategic partnerships with Zai Lab, Incyte Corp, Les Lab, and others.

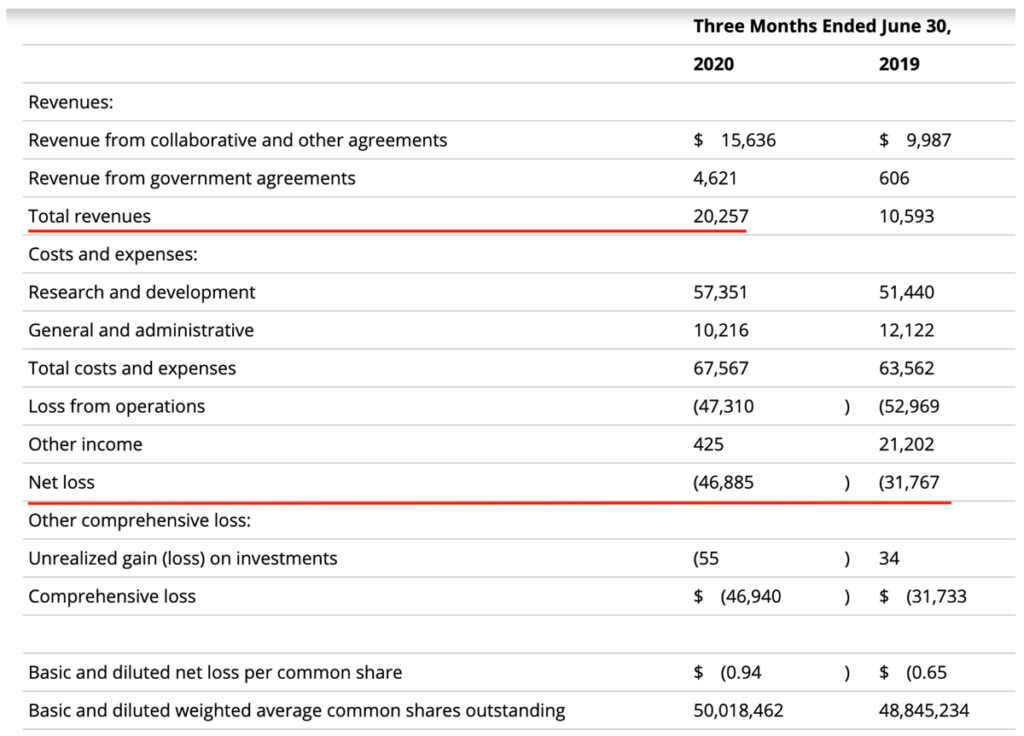

Its revenue even doubled in the second quarter of this year, reaching $ 20.2 million in revenue against $ 10.5 million last quarter. Thanks to new agreements with companies and governments.

However, its loss was more significant than when compared to 2Q19. The company delivered a loss of $ 46.8 million compared to a loss of $ 31.7 million10. This was likely due to the high costs it has with R&D (Research and Development) compared to its revenue generated.

It employs 364 employees, and in 2019, it generated about $ 64.2 million in annual revenue. Currently, its market value is approximately $ 1.4 billion11.

Its shares have risen only 4% since its IPO in 2013. This is because no therapy has been launched; all are still under development and testing.

ZYMEWORKS (ZYME)

Zymeworks is a biotechnology company that has a trio of platform technologies that help with drug discovery. Founded in 2003 and headquartered in Canada.

It is involved in the development of new therapies aimed at treating cancer. However, the company still does not have an approved therapy for any treatment, which are underway.

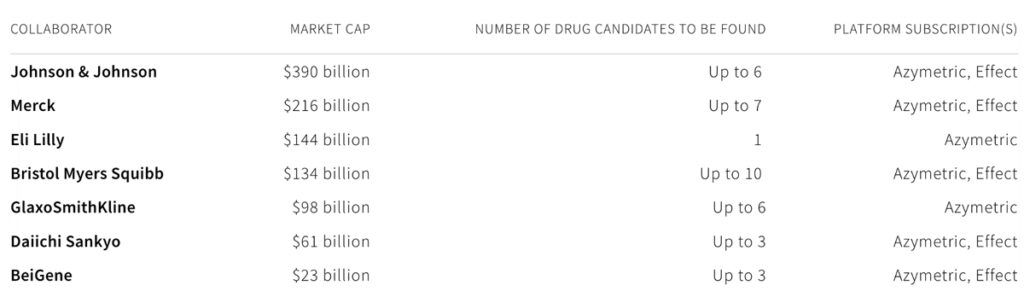

In the same way that MacroGenics makes money, it earns its revenue through collaborations with other companies and offers its platforms’ services.

That is:

• Azimetric: Helps scientists find multifunctional therapies that can reach more than one target.

• Effect: Helps researchers to personalize and optimize the immune response.

• Zymelink: A platform for several next-generation antibody drugs (ADC)

Even though it is a small company in market value, it serves clients that are well-established in the healthcare sector12:

Source: https://www.nasdaq.com/articles/3-top-biotech-picks-for-2025-2020-09-20

Its revenues have grown, however, its expenses too, which can make it difficult to deliver any profit these days. But it is interesting to see how she has well-established customers who look to be eager for her products and how her therapy pipeline is expected to grow over the next five years.

As you can see in the image above, her revenue was $ 12.3 million in the last quarter and was up 56.8% over the same period in the previous quarter13. However, if we see the growth in operating expenses, in the R&D (Research and Development) part, we realize that the increase was 64.8% and was higher than the revenue.

Therefore, it is unlikely to deliver an operating profit or a decent net profit. But that does not mean that it is not a good company. Its leading molecule, for example, is Zanidatamab and is being evaluated as a top treatment for cancers that express HER2, including breast cancer. This therapy is currently being evaluated in Phase 1 and 2 by the FDA.

Zymeworks currently employs 180 people, and in 2019, it came to delivering around $ 29.5 million in annual revenue from its collaborations14. It now has a market value of approximately $ 2.1 billion, and its shares have accumulated a 255.5% increase since the IPO in 2017

The biotechnology industry can be significantly affected by patent considerations, intense competition, rapid technological change and obsolescence, and government regulation, and revenue patterns can be erratic.

1. https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

2. https://finviz.com/screener.ashx?v=111&f=sec_healthcare&o=marketcap&r=1021

3. https://www.statista.com/statistics/309457/world-pharmaceutical-revenue-distribution-by-technology/

4. https://www.breastcancer.org/symptoms/understand_bc/statistics

5. hhttps://gis.cdc.gov/Cancer/USCS/DataViz.html

6. https://s21.q4cdn.com/327105422/files/doc_downloads/2Q20-Conference-Call-Slides_FINAL_30July2020_WEBSITE.pdf

7. https://www.marketbeat.com/stocks/NASDAQ/SGEN/

8. https://www.macrogenics.com/pipeline/

9. https://www.fool.com/investing/2020/07/09/heres-why-macrogenics-jumped-1566-in-the-first-hal.aspx

10. http://ir.macrogenics.com/news-releases/news-release-details/macrogenics-provides-update-corporate-progress-and-second-4

11. https://www.marketbeat.com/stocks/NASDAQ/MGNX/

12. https://www.nasdaq.com/articles/3-top-biotech-picks-for-2025-2020-09-20

13. http://d18rn0p25nwr6d.cloudfront.net/CIK-0001403752/362d4bfb-5a94-4eb9-b0b1-cbbcfae1f519.html

14. https://www.marketbeat.com/stocks/NYSE/ZYME/