Cash is King – Suggestions

So, let’s go to a list of ten Cashs Kings.

More than a simple list of companies with a high cash position, we seek to list here companies from different sectors, different sizes (market value), and which also include high cash compared to their indebtedness.

The following list is not a portfolio recommendation, nor will it be accompanied regularly with suggestions for exchanges or changes, nor do we want to determine the share of capital that should be allocated in any of the parts listed here. We remind you that every investment must follow and respect your investment profile.

There is always the potential to lose money when investing in securities or other financial products. Investors must carefully consider their investment objectives and risks before investing. The price of a particular security may rise or fall based on market conditions, and customers may lose money, including their original investment. Products are not insured by the FDIC, are not guaranteed by banks, and may lose value.

GAMES AND INTERNET

Twitter (TWTR)

Twitter (TWTR) Known to many, Twitter differs from other internet companies in terms of its cash position. They have more than $ 7.67 billion in cash, which represents something like 30% of their market value. Its operating costs and expenses reached the US $ 3 billion, and its debts were US $ 4.1 billion. Itmeans that Twitter today would have the resources to pay off all its debts and still support the company’s operation for 12 months, and there would still be more than US $ 500 million in cash.

In the year, its shares fell by approximately 13%. – with 05.01.2020 as the reference date.

![]() Activision Blizzard, Inc. (ATVI)

Activision Blizzard, Inc. (ATVI)

The S&P 500’s largest game company in terms of market value has approximately $ 5.9 billion in cash, something like 12% of its market value – its market value is $ 49 billion. Its debts add up to about half the size of its cash – $ 2.95 billion.

The share accumulated a 13% increase in the year and was one of the “winners” of the negative moment generated by the corona since its operations are much less sensitive to its economic impact. After all, maybe people even use their products more.

In the last five years, the company has grown its revenues at an average rate of 8% and seeking to compete in the competitive environment of mobile games. This segment has developed the most in the company. Call of Duty Mobile, for example, has already had 150 million downloads.

HEALTH

Vertex Pharmaceuticals Incorporated (VRTX)

Vertex Pharmaceuticals Incorporated (VRTX)Vertex was the first biotech company to develop drugs to treat cystic fibrosis – a genetic disease that affects the development of the lungs and other organs.

The company is today (01/05/2020) valued at US $ 67 billion and currently has cash of US $ 3.8 billion. That is, its money represents about 6% of its market value. The company has a debt of approximately US $ 670 million. That is, discounted the debt, and its net cash is about US $ 3.1 billion.

Would it be enough for her to continue operating, even if she does not earn any revenue for the next 12 months?

Although this is a very hypothetical situation, the answer is yes. Its costs and expenses in the last 12 months were around US $ 3 billion, with a large part referring to Research and Development of new drugs and treatments, and not operating expenses.

Despite the challenging market moment, its shares have accumulated 18% increase in the year.

![]() Humana Inc (HUM)

Humana Inc (HUM)

Humana is a health insurance company that operates in the USA in the Retail, Group, and Specialty segments. The company has approximately 17 million members on medical benefit plans, in addition to about 5 million members on specialty products. Humana Inc. was founded in 1961 and is headquartered in Louisville, Kentucky.

The company has a market value of $ 49 billion (05.01.2020) and has approximately $ 15 billion in cash; that is, 31% of the company’s market value is in its money. The company has some debt (in the order of US $ 9 billion), but it is still considered a net cash company (its cash exceeds its obligations by US $ 9 billion).

Recently, they announced that they would bear all the costs of coronavirus treatments, even for patients with a plan called co-pay, which are cost-sharing. Humana has pledged to work with federal authorities to ensure that patients do not receive surprising bills for their treatment.

“We are taking this action to help ease the burden for the elderly and others who are currently struggling. No American should worry about the cost of care when being treated for coronavirus,” said Bruce Broussard, Humana’s president, and CEO.

In short, they must feel a strong cost impact in the next results, due to the expenses with the treatment. However, there is no way to predict how much, but the important thing is that the company has a robust box to absorb this. Still, given their size, they have been working closely with the American government to meet the needs of their policyholders. Recently, they successfully issued debt of more than US $ 1 billion to reinforce their cash.

In the year, the company’s shares appreciated 2.8%.

COMPANIES WITH A TOUCH IN THE FINANCIAL WORLD

Paypal (PYPL)

Paypal (PYPL) The PayPal payment system was founded in 1998. Acquired by eBay in 2002, it underwent a spin-off in 2015, again becoming an independent company. The company provides electronic payment solutions for merchants and consumers, with a focus on online transactions. They also own Xoom, an international money transfer company, and Venmo, a person-to-person payment platform.

The online payments company, which has a market cap of more than $ 145 billion, has a cash position of $ 10.8 billion (7.5% of its market value).

The company has debts of US $ 5.5 billion. That is, even if they chose to pay all their debt, they would still have something like US $ 5.3 billion in cash.

Over the past three years, revenues have grown by an average of 17% per year and profit by 20%, with a return on equity of around 13% to 15%, a number higher than large US banks. The profit margin on each dollar of revenue showed impressive stability. Since 2015, they have maintained their profit margin at 13%.

For those who believe that the current crisis tends to generate long-term and permanent impacts on consumption, causing more and more people to use online, Paypal is likely to benefit in the long run. Obviously, in the short run, bankruptcy for smaller businesses tends to be bad for them.

In the year, its shares appreciated 12%, considering 05.01.2020, as the reference date.

![]() Intuit Inc. (INTU)

Intuit Inc. (INTU)

Intuit is an American software company that develops and sells financial, accounting, and tax preparation systems and products, as well as other products and services for small businesses, accountants, and individuals. The California company has seen its shares triple in value over the past three years, in response to the growth in its numbers. Both revenue and profits grew by more than 50% in the period. Nevertheless, the company has high profitability, with a profit margin of 23% and a return on equity of more than 40%.

The current crisis has raised doubts about its short-term results because they have many small businesses as customers. Although many of them are suffering, Intuit products help entrepreneurs to reduce costs. They may even be an alternative for smaller businesses that seek to reduce costs amid the crisis. Nevertheless, the company has a broad market to be explored and/or to advance in terms of internationalization. Recently, they acquired Credit Karma (for $ 7 billion), which in short is a credit score calculation application that helps users find financial products that fit their profile.

The company has $ 2.3 BI in cash and $ 754 MM in debt, that is, a net cash position of $ 1.5 billion.

In 2020, its shares were stable until the beginning of May, and in 12 months, they appreciated 7.8%.

OTHER COMPANIES’ IN THE TECHNOLOGY SECTOR

Nvidia (NVDA)

Nvidia (NVDA) NVIDIA Corporation is a technology giant, with a market cap of more than $ 185 billion. Its operating segment is semiconductors (chips), video cards, and processors. They are prominent in visual computing around the world. The company’s products are used in the gaming, professional visualization, data center, and automotive markets, among others. NVIDIA Corporation sells its products to equipment and device manufacturers, system builders, expansion card manufacturers, resellers/distributors, Internet and cloud service providers, automobile manufacturers, and more. NVIDIA Corporation was founded in 1993 and is headquartered in Santa Clara, California.

The company has cash of US $ 10.9 billion (about 6% of its market value) and has a debt of US $ 2.6 billion, that is, net cash of US $ 8.2 billion. Considering that in the last 12 months, its costs and expenses were US $ 8 billion, we can say that the company could go one full year without revenues and still have resources to pay all its debts, costs, and expenses as if it were operating normally.

In the year, its shares appreciated 21%, considering 05.01.2020, as the reference date.

![]() Cisco (CSCO)

Cisco (CSCO)

Cisco Systems, Inc. designs, manufactures, and sells routers, switches, and other products related to the communication and information technology industry in the Americas, Europe, Middle East, Africa, Asia-Pacific, Japan, and China. It provides infrastructure platforms, including network technologies for switching products, wireless routing, and data center. The company also offers collaboration products that include communications, such as Cisco TelePresence and conferences, in addition to the Internet of Things and analytics software. The corporation serves companies of various sizes, public institutions, governments, and service providers. Cisco Systems, Inc. was founded in 1984 and is headquartered in San Jose, California.

The company has US $ 27 billion in cash, something like 15% of its market value (US $ 175 billion). Their debt is US $ 17 billion, that is, considering what they have in cash, they could clear their remaining debt, US $ 10 billion in cash.

However, in recent years the company has maintained good revenue stability and operating results, with profits growing 13.5% per year for the past five years and a high return on equity of around 30%.

Its shares accumulated a drop of around 14% in the year, considering 05.01.2020 as the reference date.

![]() Salesforce.com, inc. (CRM)

Salesforce.com, inc. (CRM)

Salesforce.com, Inc. provides enterprise software focusing on CRM (Customer Relationship Management) and using the cloud as an information file. The company focuses on cloud, mobile, social, Internet of Things (IoT), and artificial intelligence technologies. Its services are aimed at sales force automation, customer service and support, marketing automation, digital commerce, IoT integration, productivity tools, and much more. Its cloud service offerings include Sales Cloud, Service Cloud, Marketing Cloud, among others. The company has a market value of US $ 144 billion.

Since 2017, the company’s revenues have doubled, even though profit has not grown, a sign that they continue to invest, and their businesses are still in an expansion phase.

Despite this, the business model and the product they offer fits very well in the current scenario of greater automation of processes and the use of tools, such as theirs, for managing companies.

The company has about $ 8 billion of cash (about 6% of its market value) and $ 3 billion of debt, that is, net cash of $ 5 billion. In the year, its shares fell by just over 3%, considering 05.01.2020, as the reference date.

![]() Accenture (ACN)

Accenture (ACN)

Accenture provides consulting services worldwide regardingtechnology, communication, media, financial, and other segments. It has clients such as Amazon, Google, Microsoft, Oracle, Salesforce, SAP, and others. The company has a market value of $ 118 billion.

In the last four years, its revenues have been growing at an average of 8% per year and have reached US $ 43 billion in the last 12 months. Profits, on the other hand, grew less, at an average of 5%. The relevant point in the company’s analysis is its high return on invested capital – 30%. This results from the fact that its product is a service that does not require massive investments and is a strong cash generator – its free cash flow for the last 12 months was approximately US $ 6 billion.

Despite suffering some impact due to the crisis, something difficult to measure, it is possible that there is some increase in demand for its services that aim to optimize results, reduce costs and expenses. In its latest earnings release, it was worth noting the increase in new service contracts worth US $ 14.2 billion, a record performance in the consulting and outsourcing sectors. In comparison, in the previous quarter, it had reached just under $ 12 billion in contracts. Also, the company guided revenue growth for the year in which it considers the impacts of the corona. It expects revenue to grow by 4.5% in 2020.

The company has $ 5.4 billion and $ 3.4 billion in debt, so net cash of $ 2 billion.

In the year, its shares accumulated a drop of 14.6% considering 05.01.2020, as the reference date.

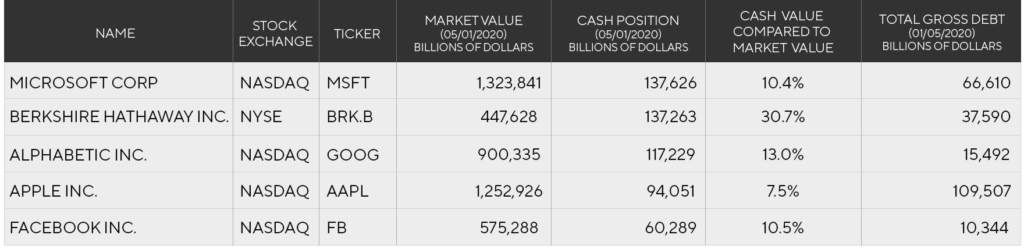

FIVE MEGA CAPS

![]() Microsoft is the largest company in the group and the one with the highest cash value, which represents 10% of its market value. Your cash would be more than enough to buy other large companies like IBM, or Wells Fargo bank, or Costco supermarket.

Microsoft is the largest company in the group and the one with the highest cash value, which represents 10% of its market value. Your cash would be more than enough to buy other large companies like IBM, or Wells Fargo bank, or Costco supermarket.

![]() Berkshire Hathaway has a cash value very similar to Microsoft. However, since its market value is lower, proportionally, its cash represents a more significant share in proportion to its market value – just over 30%. In other words, when you buy company stock for $ 182.67 (quoted on May 1), about $ 55 is for resources that are already in the company’s cash.

Berkshire Hathaway has a cash value very similar to Microsoft. However, since its market value is lower, proportionally, its cash represents a more significant share in proportion to its market value – just over 30%. In other words, when you buy company stock for $ 182.67 (quoted on May 1), about $ 55 is for resources that are already in the company’s cash.

![]() Alphabet (Google’s parent company) today has more than $ 117 billion, about 13% of its market value. As if that was not enough, in the last 12 months, the company had a free cash generation of another US $ 29 billion.

Alphabet (Google’s parent company) today has more than $ 117 billion, about 13% of its market value. As if that was not enough, in the last 12 months, the company had a free cash generation of another US $ 29 billion.

![]() Of the five companies in this group, Apple is the one with the highest indebtedness – over US $ 109 billion. But this is not a problem in the face of the company’s strong operating cash generation (EBITDA), which reached more than US $ 63 billion in the last 12 months.

Of the five companies in this group, Apple is the one with the highest indebtedness – over US $ 109 billion. But this is not a problem in the face of the company’s strong operating cash generation (EBITDA), which reached more than US $ 63 billion in the last 12 months.

![]() Finally, Facebook has 10% of its market value kept in cash waiting for new acquisition opportunities, as WhatsApp did with Instagram.

Finally, Facebook has 10% of its market value kept in cash waiting for new acquisition opportunities, as WhatsApp did with Instagram.