Investindo em Games – Investment Thesis

Consideration 1

Sector in full growth

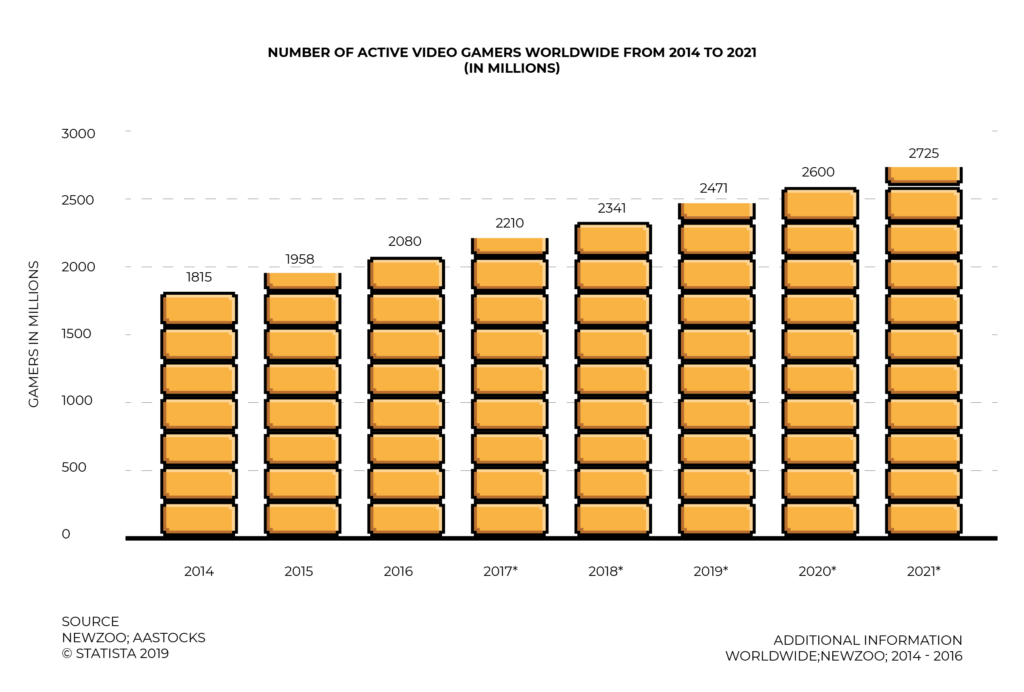

According to a study by Microsoft1, there are more than 2 billion players, that is, approximately 25% of the global population plays. This number ranges from those who play free (Free-to-Play) on their smartphone to those who use a high-end computer. The chart below corroborates Microsoft’s statement, showing that in 2019 there were already 2.4 billion players around world.

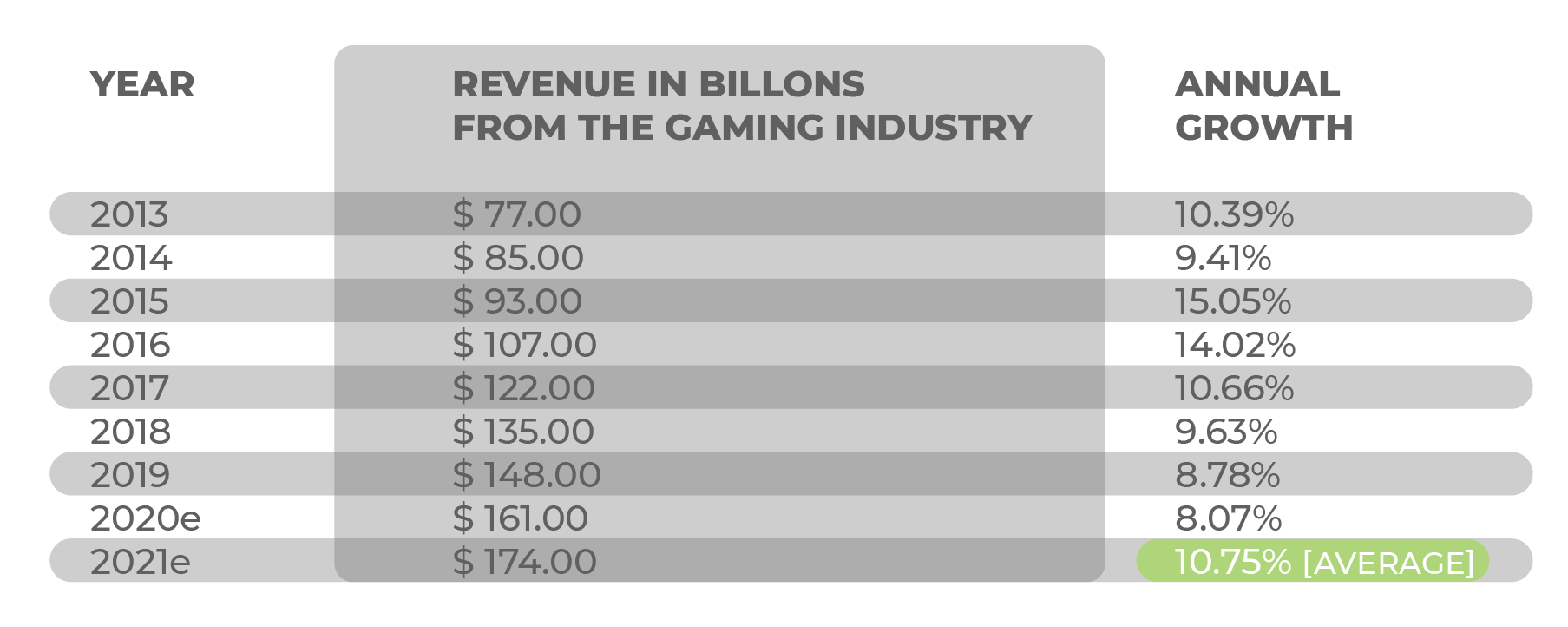

Investing in the games market is to invest in a sector that has been growing at an annual average of approximately 11% in revenue. It is estimated that by 2023, the number of players around the world will reach 3 billion.2

Would that be an anti-crisis sector? We cannot say that. However, according to the chart below, this segment has been showing consecutive sales growth since 2013, with its revenues having nearly doubled in the last five years.

Therefore, this is the first reason to consider investing in the games sector: the growth it has been experiencing, and the opportunities for continuing this growth.

Consideration 2

Geography and segments

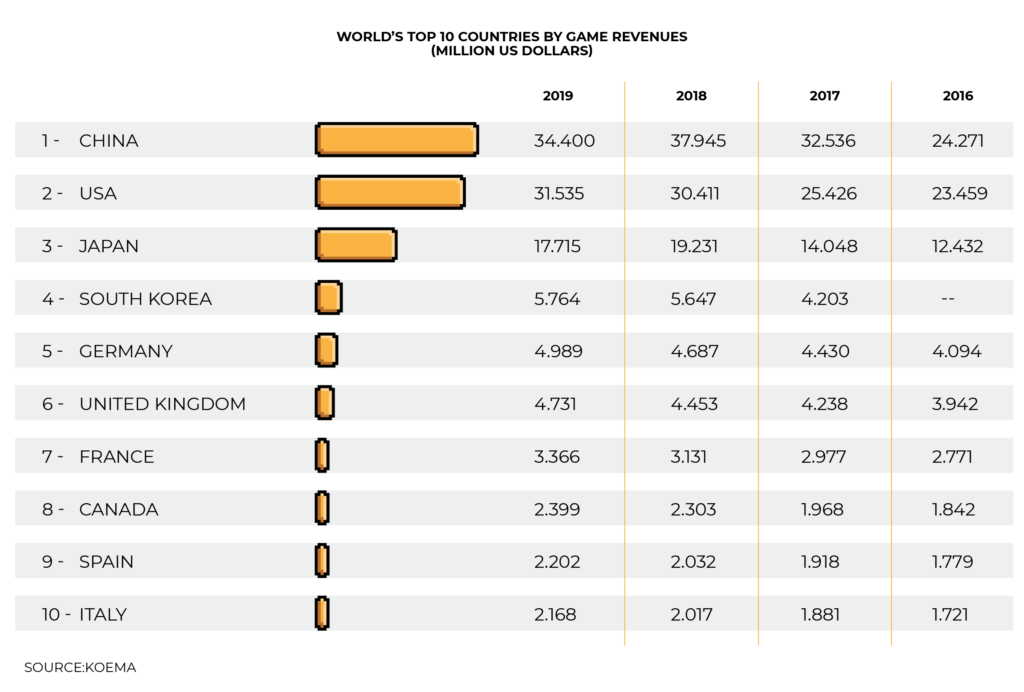

In terms of geography, in recent years, we have seen China’s emergence, which has become the primary market in the sector, with higher revenues than the American market 3 – see the chart below.

In the United States, California is the central hub for companies, housing about 95 companies. Two of the largest of the sector are located in the states.

If you keep thinking that the game market is still restricted to consoles, know that this has changed. The chart below shows the revenue breakdown for different segments of the sector.

It is possible to notice in the chart that the mobile segment’s growth is a cornerstone that has sustained the the sector’s evolution. Even what has driven this growth in recent years is smartphones.

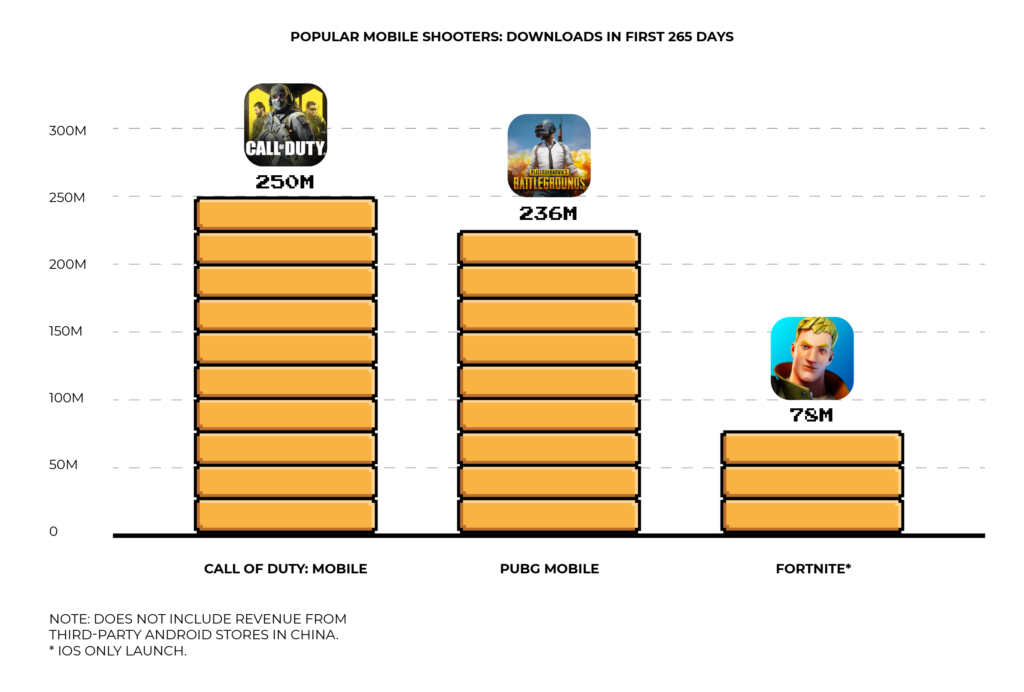

In 2019, we had several releases of mobile games that were previously exclusive to computers or consoles, such as PUBG and Call of Duty, which had more than 235 million registered users and 250 million downloads5 in the first 265 days of release, respectively. Stock prices of Sea Limeted, the parent company of the mobile game Free Fire, saw its shares nearly quadrupled in 2019.

However, this sector has other essential segments, such as:

CONSOLES

PLATFORMS

STREAMING

E-SPORT

These successes in the gaming industry, which occur across Asia and Latin America, help increase the number of global players, ways of monetization, and the ecosystems of e-sports.

A second reason for considering investing in the sector is that it is not restricted to a single geography and a single segment. In other words, we are talking about an increasingly global and diverse industry, which generally creates mechanisms for generating revenue and growth in different aspects.

Consideration 3

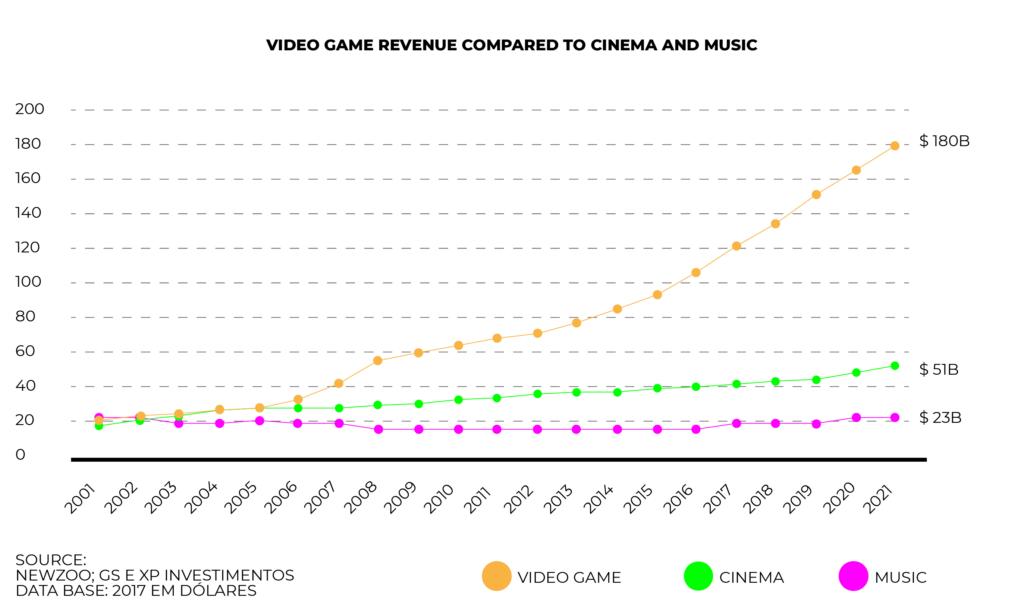

A sector bigger than Music and Cinema

The games industry occupies a relevant space within the entertainment sector but has not yet received all the attention it deserves compared to other industries. The chart below shows a discrepancy concerning the revenue generated by the entertainment industry when it comes to video games:

The games industry has been growing over the years, and its revenues already surpass the music and cinema industries combined.

That growth did not happen out of anywhere. The evolution of the internet has helped. Today, global traffic is much higher than in the past, having grown by over 1000% in the past 20 years6. In the last decade, we have popularized several games, such as sports (e-sports). Teams compete against each other in televised championships (ESPN or via streaming), with audiences that fulfill whole stadiums, also buying souvenirs from the leading teams and games.

These championships generate approximately U$ 655 million 7 in revenue per year, with more than 500 million viewers8 (a larger audience than Baseball and Golf).

The third reason to consider investing in this sector is its size and relevance in the entertainment industry .

Although there are some valid reasons to invest in the sector, every investment has risks. Let’s see the bearish view on the topic and what can go wrong:

Bearish view – What could go wrong?

It is a very competitive sector, where many companies depend on the success of their games or console releases, which is not always the case. A classic case was Nintendo’s regarding the Wii U launch, which proved to be a fiasco. In the first two days after the launch, its shares fell more than 10% and reached levels not seen since 20069.

Some companies also rely on platforms or exclusive contracts. A platform crash is a case with Epic Games with Apple. The companies started a dispute over the publishing and transaction charging methods of the Fortnite game on the App Store.

Many companies only develop games and rely on third-party platforms to display their productions. Others must adapt or comply with specific standards before launching a project. There is a substantial regulatory and security control (ESRB) that varies between countries.

Several companies need licenses for game publications, which often come from their competitors. Also, innovations can cause significant disruptions in the industry, forcing several companies to adapt suddenly, which can affect their future results.

The thesis was written in September/2020

1. https://blogs.microsoft.com/blog/2019/05/20/video-games-a-unifying-force-for-the-world/

2. Check the chart below:

3. https://newzoo.com/insights/articles/games-market-engagement-revenues-trends-2020-2023-gaming-report/

4. https://knoema.com/infographics/tqldbq/top-100-countries-by-game-revenues

5. https://www.gameindustrycareerguide.com/best-cities-for-video-game-development-jobs/

6. https://www.digit.in/news/gaming/call-of-duty-mobile-crosses-250-million-download-mark-high-than-pubg-mobile-at-the-same-time-period-55071.html

7. https://www.internetworldstats.com/emarketing.htm

8. https://globalnews.ca/news/4420706/esports-starcraft-lol-pro-gamer-dota/

9. https://www.roundhillinvestments.com/research/esports/esports-viewership-vs-sports

10. https://www.gamesindustry.biz/articles/2011-06-08-nintendo-shares-fall-after-wii-u-revealfall