How to invest in the real estate sector through Avenue

One way to invest in the US real estate sector is the Real Estate Investment Trust (REITs). Simply put they are the American version of real estate funds, such as we have in Brazil. If you don’t know them, the system consists of a company that receives resources from investors so that it can purchase and manage real estate or real estate investments. Once this initial funding is made, investors receive quotas from this company. These shares are traded on the secondary market – the stock exchange – as well as the shares. From the investor’s point of view, the rationale is to provide the opportunity to be a shareholder in large ventures that are often not easily accessible.

Here we list a few examples for you to expose yourself to real estate investment in the USA.

Please, keep in mind that these are not recommendationss.

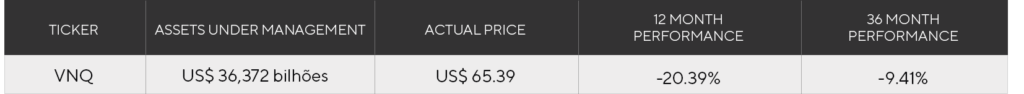

Vanguard Real Estate Index Fund is a fund (ETF) that allows investors a broad exposure to the real estate sector at a low cost. The investor pays the equivalent of 0.12% per year in administration fee for the fund to offer a balanced exposure to more than 180 different REITs, in the most diverse segments and sectors. The fund’s portfolio has about two-thirds of the American REITs market, most of which are large or medium-sized companies (~ 75% of the fund’s portfolio). In the last few months, it has provided a yield of 3.3%.5

This is an alternative for those who want to be exposed to the real estate sector and value diversification, avoiding the risk of a specific asset.

The fund’s top five portfolio positions:

![]() Crown Castle International Corp (CCI)

Crown Castle International Corp (CCI)

![]() Prologis Inc (PLD)

Prologis Inc (PLD)

![]() Equinix Inc (EQIX)

Equinix Inc (EQIX)

![]() Simon Property Group Inc (SPG)

Simon Property Group Inc (SPG)

2. Welltower Inc (WELL)

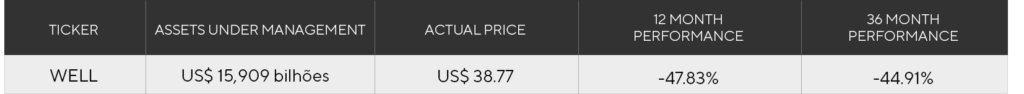

It is a REIT that focuses on the creation of real estate infrastructure for the care and well-being of the elderly, medical clinics and homes for people who need special care. The company has 2 million square meters inbuilt area, with operations in the USA, Canada, and the United Kingdom. They have seen their profits grow by around 8% per year for the past five years and as a result of this, their shares have appreciated by more than 70% in the period. Besides, the company may be well-positioned to take advantage of the favorable vector, which is an increase in average life expectancy, as well as an aging population

The idea behind the investment in Welltower is to be a shareholder in high-quality real estate ventures, in a company that has the know-how to execute and manage these investments and to be positioned in a specific segment of the real estate market that has a favorable demographic perspective. Welltower is not an asset for those looking for dizzying growth, but the aging of the population (in its markets) must sustain its results for years.

1. Reit.com – TheBasispoint.com

2. Tradingeconomics.com

3. https://www.weforum.org/agenda/2019/04/50-years-of-us-wages-in-one-chart/

4. https://www.cnbc.com/2019/01/04/surge-in-e-commerce-gift-returns-has-boosted-the-warehouse-sector.html

https://www.cnbc.com/2019/01/04/surge-in-e-commerce-gift-returns-has-boosted-the-warehouse-sector.html

5. The trailing 12 months.