Investimento em Games – Suggestions

Ways to invest in the gaming sector through Avenue

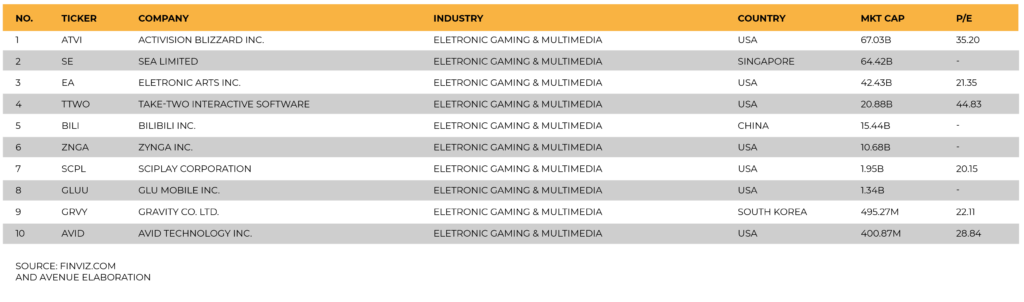

Around 18 companies are directly linked to the games sector and another are indirectly linked, but contribute significantly. Overall, game companies account for 0.5% of the S&P5001. The chart below shows the ten largest companies according to their market value.

THREE ASSETS TO EXPOSE TO THE SECTOR

1. Wedbush ETFMG Video Game Tech ETF – GAMR

Given that this is a dynamic sector, with intense competition and an essential presence of technology in all of its processes, we understand that a way to expose yourself to the industry is through an ETF to help manage risk and with has the ability to increase diversification.

Because of their narrow focus, sector investments tend to be more volatile than investments diversifying across many sectors and companies.

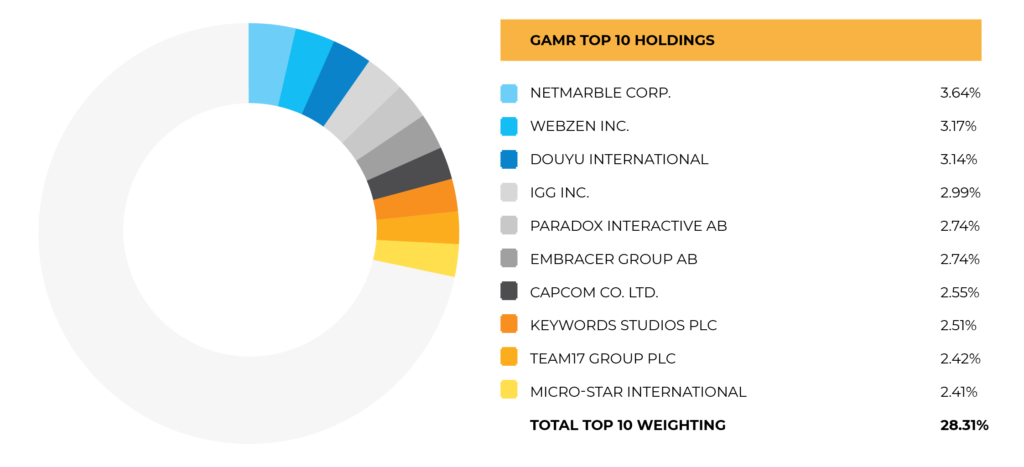

The Wedbush ETFMG Video Game Tech ETF generally corresponds to a stock index of global companies that support, create, or use video games.

GAMR has companies of all types. Its portfolio comprises 90 companies from different countries, with 60% of its composition concentrated in countries like the United States, Japan, and South Korea.

Its five largest positions are:

2. Activision Blizzard (ATVI)

It is one of the largest companies in the gaming industry and was born from the merger between Activision and Blizzard in July 2008. It is part of the S&P500 and is a member of the Fortune 500. Its headquarters are in the United States, Santa Monica, California.

Under the Activision brand, they develop, distribute, and publish franchise games that have passed through some of the readers’ lives, such as the famous Call of Duty, Spyro, and Crash.

Under the Blizzard brand, they develop MMO RPG games – Massive Multiplayer Online Role-Playing Game – World of Warcraft, which to this day is one of the MMO’s with the most active players online and they pay a monthly fee to play.

Besides, it has well-known franchises, such as Diablo, Starcraft, Heroes of the Storm, Hearthstone, Overwatch, Bubble Witch, Farm Heroes, Warcraft Reforged, among others.

The company reports that it has approximately 500 million active users per month in 196 countries2 on its gaming platform. It continues to invest heavily in its franchises. The Blizzard segment focuses on new Diablo and Overwatch projects, expanding the Warcraft world, such as launching the WoW Classic, and new toy products.

Activision focuses on the launch of the new Call of Duty’s and mobile devices, with the launch of COD Mobile and, thus, the recent redefinition of the user base due to the entry into new platforms.

Highlights:

• Right moves made by Activision Blizzard.

• The most significant focus on Free-to-Play and mobiles seems to be the way;

• It has good franchise names that tend to benefit from the generation turn;

• It is one of the largest American companies in the sector.

3. Take Two (TTWO)

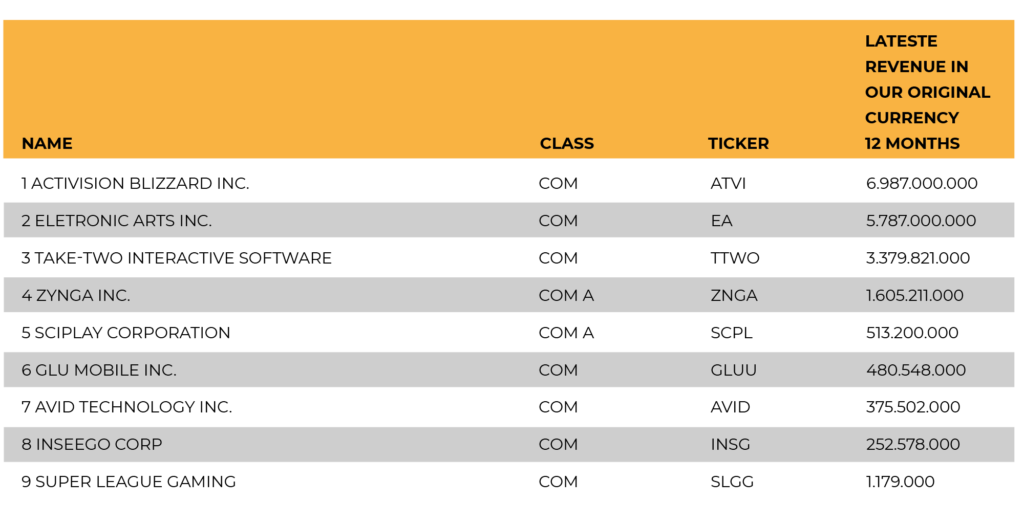

Take Two is a smaller studio, but influential in terms of game releases. It is the third-largest company in the US gaming industry by revenue.

Based in New York, it was founded by Ryan Brant in September 1993. It is currently a leading developer, publisher, and marketer of interactive entertainment for consumers worldwide. They develop and publish products through the labels Rockstar Games, 2K, Private Division, and Ghost Story, in addition to Social Point, a leading developer of mobile games.

Its products are designed for console systems and personal computers, including smartphones and tablets, and are delivered through physical retail, digital download, online platforms, and cloud streaming services.

For those unfamiliar, it develops and publishes games like Grand Theft Auto (GTA), Red Dead Redemption, the Mafia, Bioshock franchises, and others such as like NBA 2K20 Civilization, XCOM, and Borderlands.

The company has stood out3 in the past 20 years. From 2000 to 2010, total revenue grew 218%, reaching U $ 1.1 billion4. It has managed to repeat this performance in the last decade thanks to the monstrous sales of GTA V (launched in 2013) and new releases, such as Red Dead Redemption (launched in 2010).

It is worth mentioning that the company’s president, Karl Slatoff, commented that it is in the company’s plans5 to become the largest and most diversified company in the gaming sector’s history. With so many franchises, it seems possible to maintain the growth rate achieved so far.

Highlights:

• A good track record. Today GTA is the flagship, but in the past, the company has delivered several successful titles.

• Franchises with strong names and who also tend to benefit from the generation turn.

• Take Two looks to have sufficient cash to make an exciting purchase; this can unlock more value for the company.

• Future Outlook: As it is a smaller studio, it has the agility to continue growing at a faster pace than some competitors.

1. https://www.slickcharts.com/sp500

2. https://investor.activision.com/static-files/2d8e1c22-0181-4453-af98-25ed39272b8a/

3. https://www.fool.com/investing/2020/03/29/nows-the-time-to-buy-take-two-interactive.aspx

4. https://www.fool.com/investing/2020/03/29/nows-the-time-to-buy-take-two-interactive.aspx

5. https://www.pcgamer.com/take-two-has-93-games-planned-for-the-next-five-years-but-no-news-on-gta/