Small and Profitables Investments Thesis

WHY INVEST IN SMALLER COMPANIES?

Smaller companies have advantages and disadvantages. Here are some:

Benefits:

• Return: Some investors are concerned with having a more attractive return on their portfolio. Therefore, stocks with a lower market value may have more significant growth on their way than companies that are already large in their respective markets. However, it is noteworthy that past returns are no guarantee of future returns.

• Growth: In return, these companies’ growth can be much more significant, and their results can surprise the market.

• Diversification: Companies with smaller capitalizations can be another option for investors to diversify their portfolios. In this way, investors can balance the risk-return compensation with the other assets in their portfolio.

Disadvantages:

• Growth risk: As they are small companies, they can be easily reached in crisis times and tend to suffer more than large companies. Larger or medium-sized companies generally have faster access to credit lines and bargain more with their suppliers to get through these periods. Typically, these smaller companies do not have these benefits because they are young and still have little strength in their operations or balance sheets.

• Volatility risk: Companies with lower capitalization tend to suffer more due to market volatility. Therefore, your stocks can undergo extreme variations both up and down. The investor has to be aware of these movements to avoid being caught by surprise.

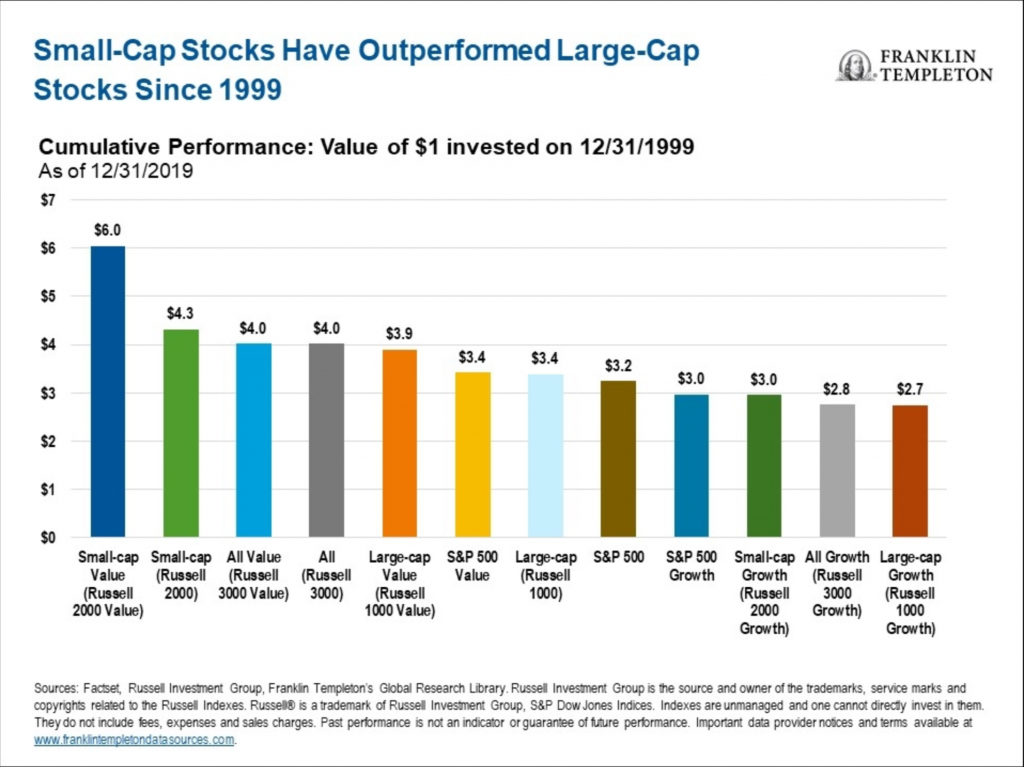

When we look at history, generally, companies with smaller capitalization (Small Caps) performed better in the long run than larger capitalization companies (Large Caps).

Does that mean it could happen again? No.

But if you are a long-term investor, companies with less debt, good profits, and high profitability will maybe prove more attractive. Analyzing the graph below, it is possible to see that Small Caps performed better than Large Caps in the last 20 years1.

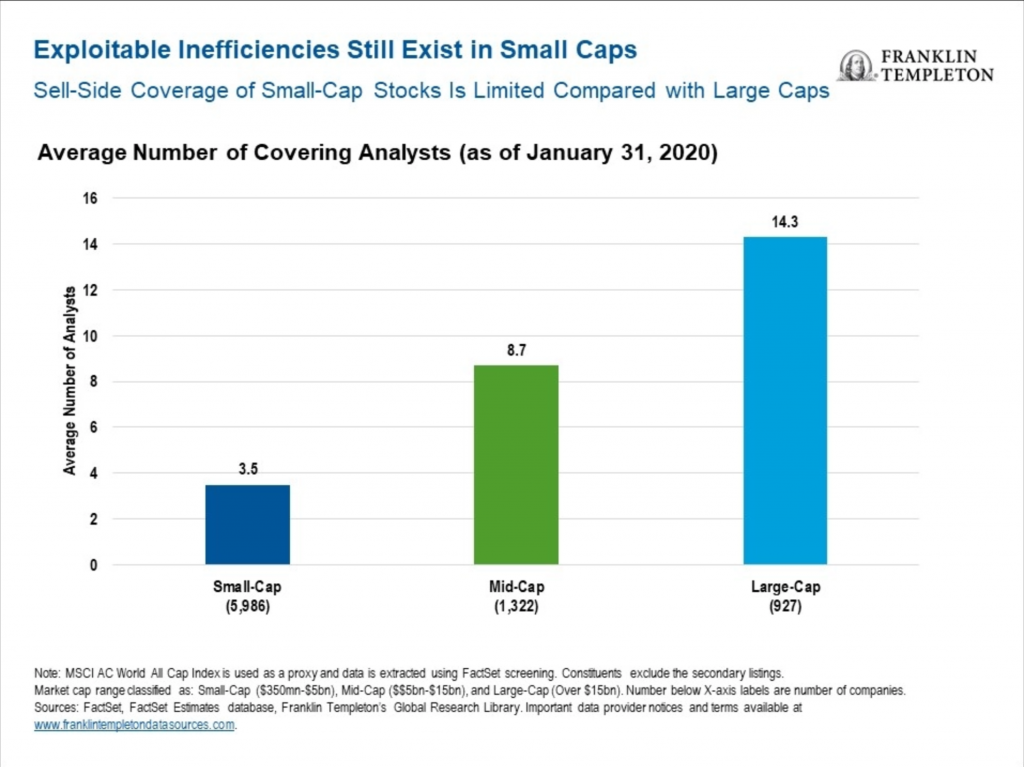

Companies with lower capitalization generally have little coverage by analysts. Typically, analysis houses end up covering more Large and Mid Caps2. This means that to bring this analysis to you, we looked at several companies to select some from this sea of companies with lower capitalization.

Understanding all this, we will now talk about the 11 selected companies.

1. https://us.beyondbullsandbears.com/2020/02/21/five-reasons-to-consider-investing-in-small-cap-value-stocks/

2. https://us.beyondbullsandbears.com/2020/02/21/five-reasons-to-consider-investing-in-small-cap-value-stocks/